This week on Outside In, we cover an insightful ‘What I Heard (WIH)’ article on HDFC Life’s Digital Initiatives over the last few years and how it has made a considerable impact on their business growth – in pre-Covid as well as post-Covid times. We are sharing my summary notes and highlights from multiple sessions by HDFC Life in various forums, over the last few months. This compilation not only serves as a single simple summary of the company’s Digital Journey, but it can also serve out as a Digital Roadmap for other Organizations out there. Hope this will be an enlightening read…

1) The 5-Forces at Play: If we were to align the Industry and Consumer dynamics of HDFC Life’s Insurance Business with Michael Porter’s 5-forces framework of Competitive Strategy, this is what we would see below.

Force 1: Power of Buyers (Customers) – Rising

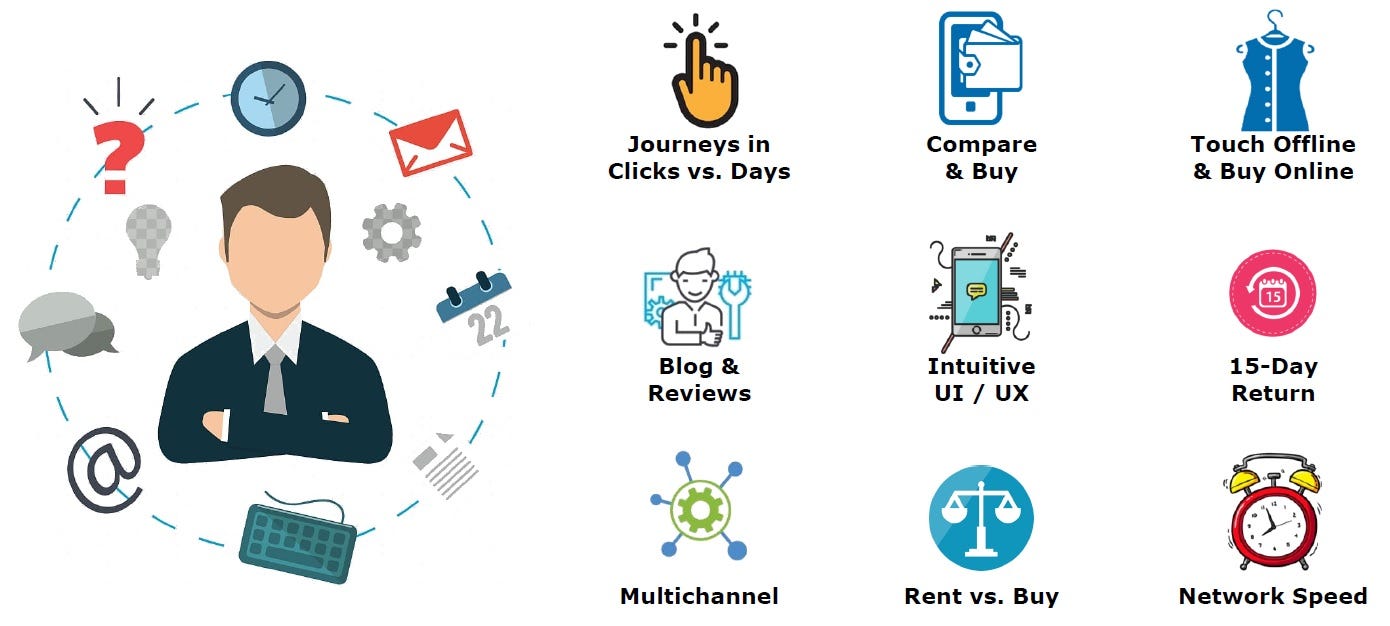

Consumer Commerce and Engagement digital enablers have completely changed the Experience expectations of Insurance Customers as well

Force 2: Power of Suppliers (Existing Insurance Players/Industry Practices) – Diminishing

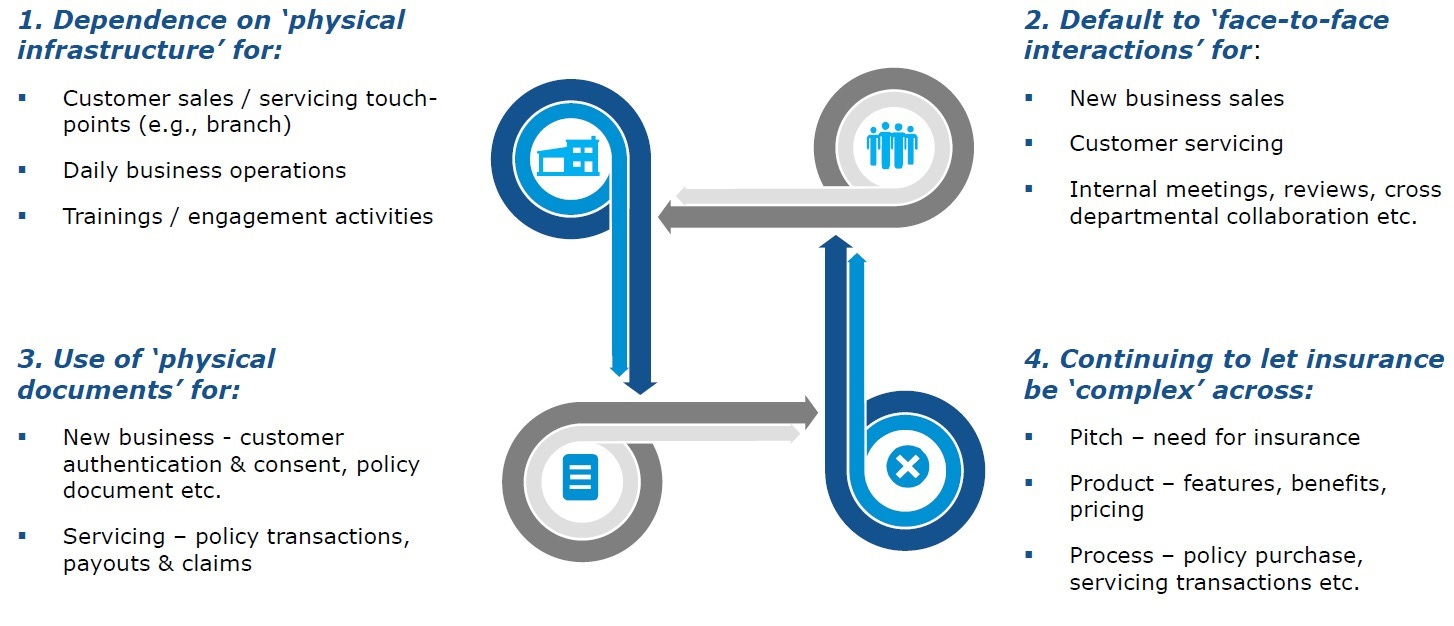

The Covid pandemic disrupted the status quo of conventional Insurance business practices in India – that was heavy of ‘physical’ processes rather than ‘digitized’ ones (and barely started on ‘digital’ ones)

Force 3: Threat of New Entrants (across the Insurance Value Chain) – Rising

From customer acquisition to underwriting to servicing and claims management, digital upstarts are disrupting every practice of the traditional Insurance business

Force 4: Threat of Substitutes (New Selling and Service Models by Digital Companies) – Rising

Coupled with brand new practices of refreshing the old processes, digital upstarts have come out with new selling and servicing models outright

Force 5: Rivalry among Competitors (and Complementary Services) – Rising

Every financial services company – including Insurance champions – are forced to look over their shoulder – wary of the fact that a core business offering can suddenly just become a ‘feature’ of a multi-feature Platform-of-Tomorrow

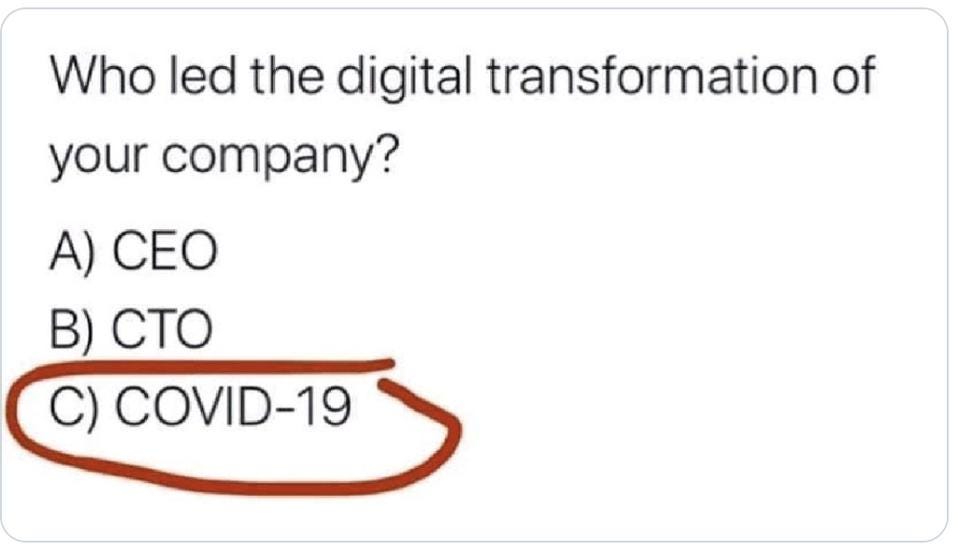

The Ultimate Force: A Black Swan Moment – Covid-19 Pandemic

Most of us have seen this social media post – which was said in jest but it is a reality for most organizations out there. The Covid-19 pandemic indeed pushed the Digital Transformation for most business across Industries – including Insurance

Let’s now deep-dive into HDFC Life’s impressive Digital Transformation journey – with a list of proactive Initiatives to begin with – which accelerated during the pandemic, transforming the way they have done business and acted as a trigger for impressive Business Growth

2) HDFC Life’s Digital Transformation Snapshot

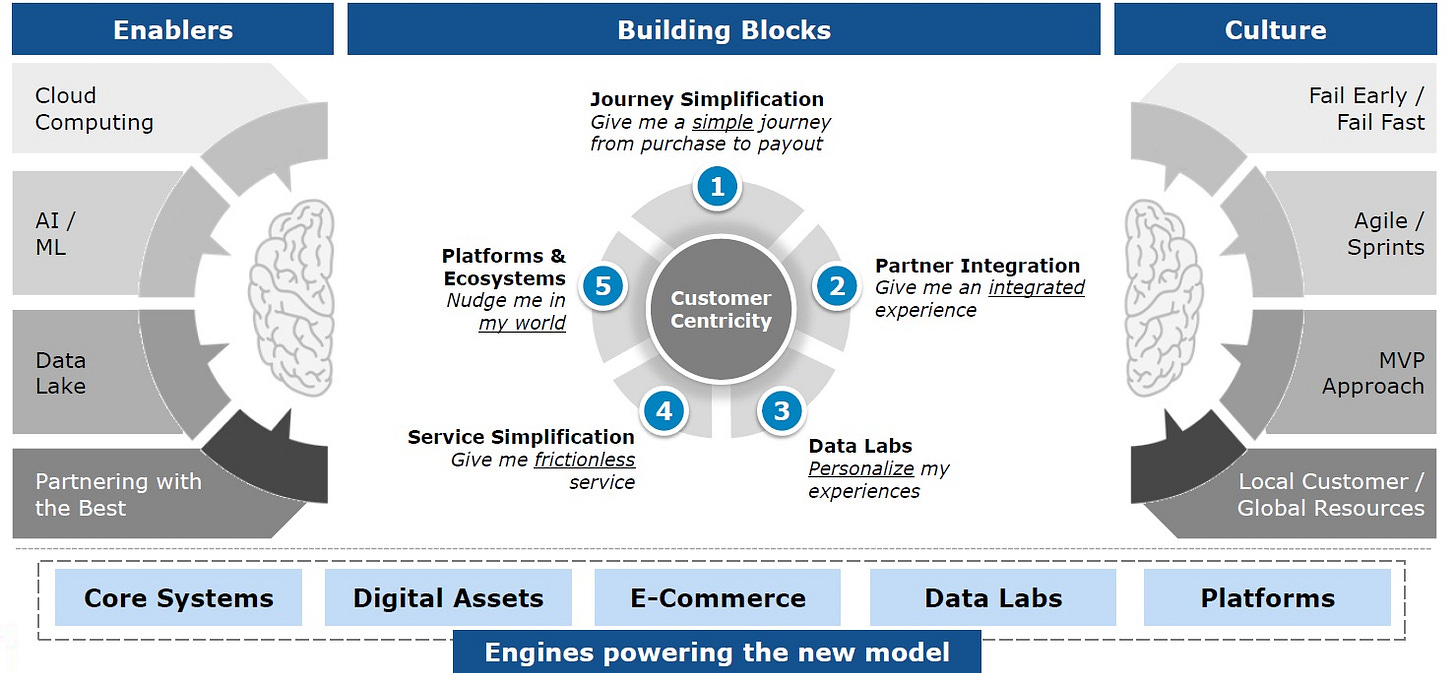

Vision – Transform towards a Customer-centric Business Model

Design Principles (adapting to a Digital World)

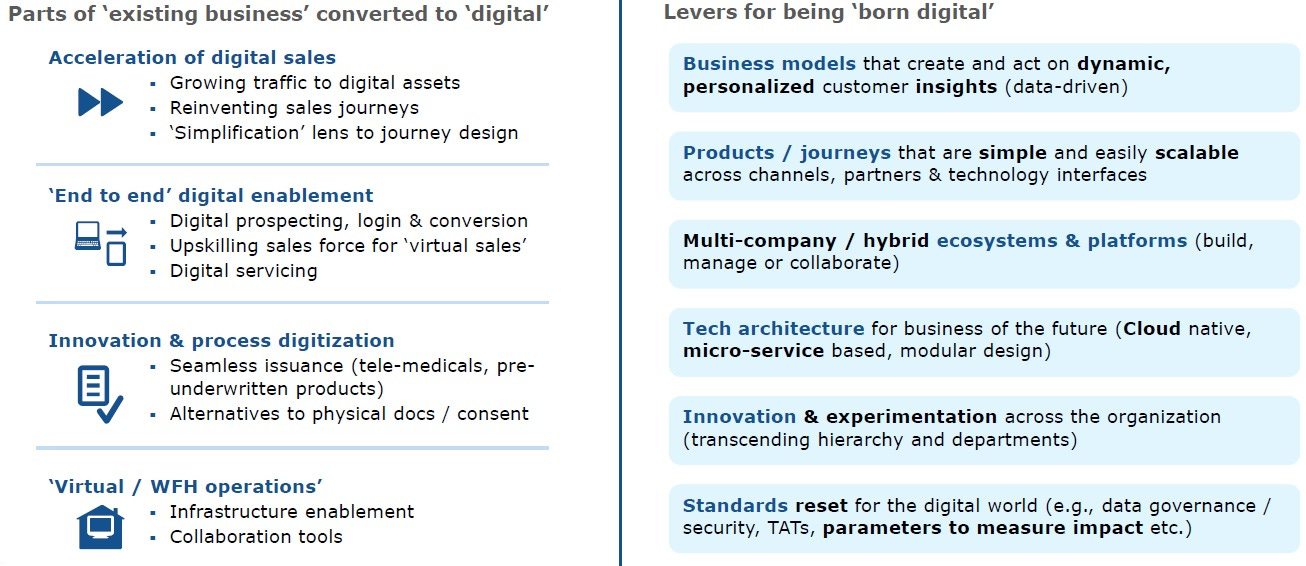

Articulation of Design Principles to shape Business Practices – which would become requirements for Digital Solutions:

Convert existing business practices to Digital

Cultivate ‘Digital-first’ practices going forward

Building Blocks – Multiple Cognitive Engines

Priority “Experience” objectives were outlined for the pursuit of Focused-Initiatives:

Simple Journeys

Integrated Experiences

Personalized Experiences

Frictionless Services

Connect with Me Conveniently

Customer Experience Transformation

Digital Initiatives were focused on these 5 key elements of their “Networked” Customer Journey:

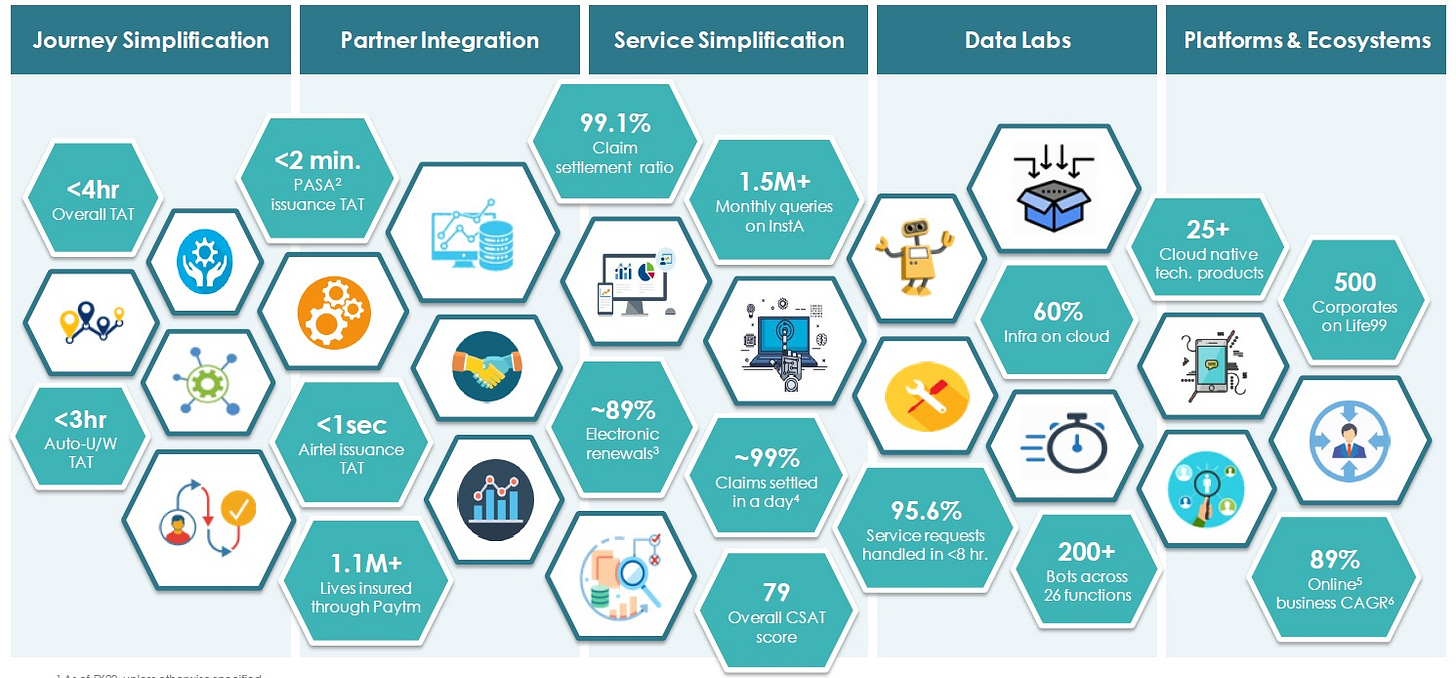

a) Journey Simplification

b) Partner Integration

c) Service Simplification

d) Data Labs

e) Platforms and Ecosystems

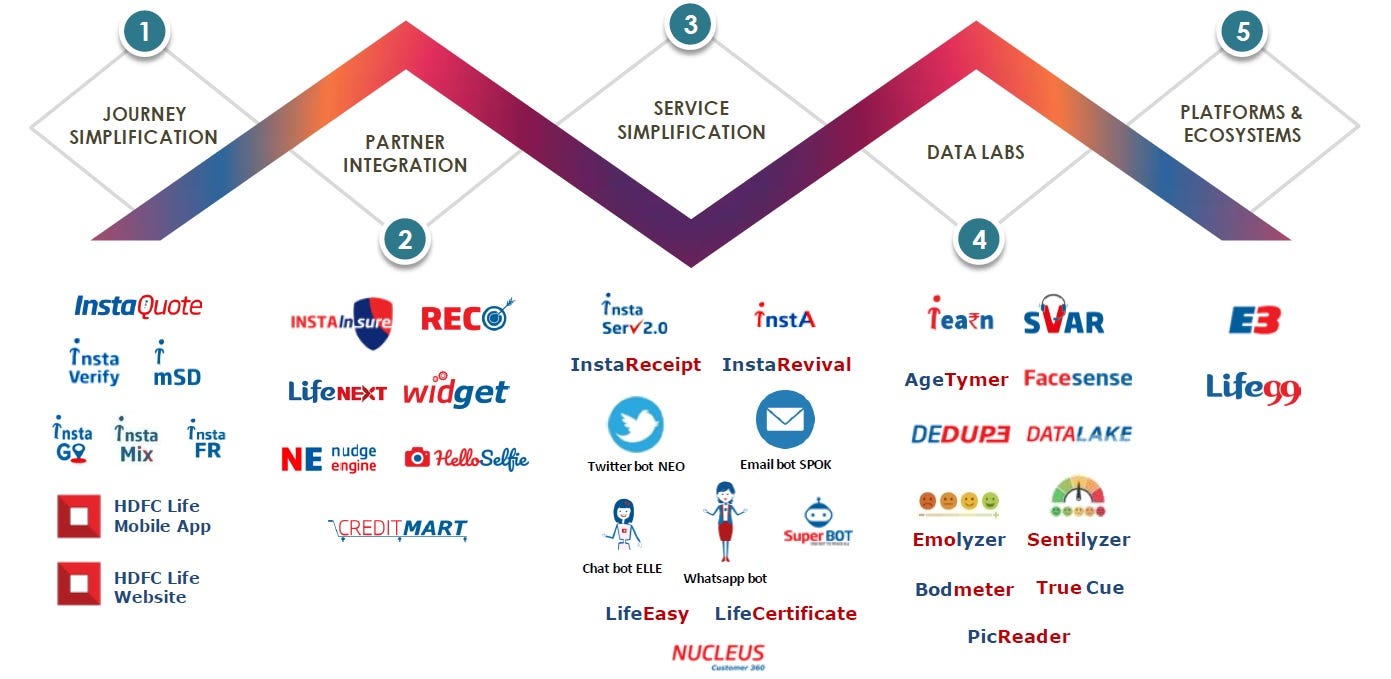

Agile Approach: Cognitive Engines rapidly developed a suite of Products & Micro-Services – aligned to serve a Customer’s Needs

Select Illustrations of Digitally-powered Customer Experiences

a) Journey Simplification

Pre-approved Offers & Click-through Journeys

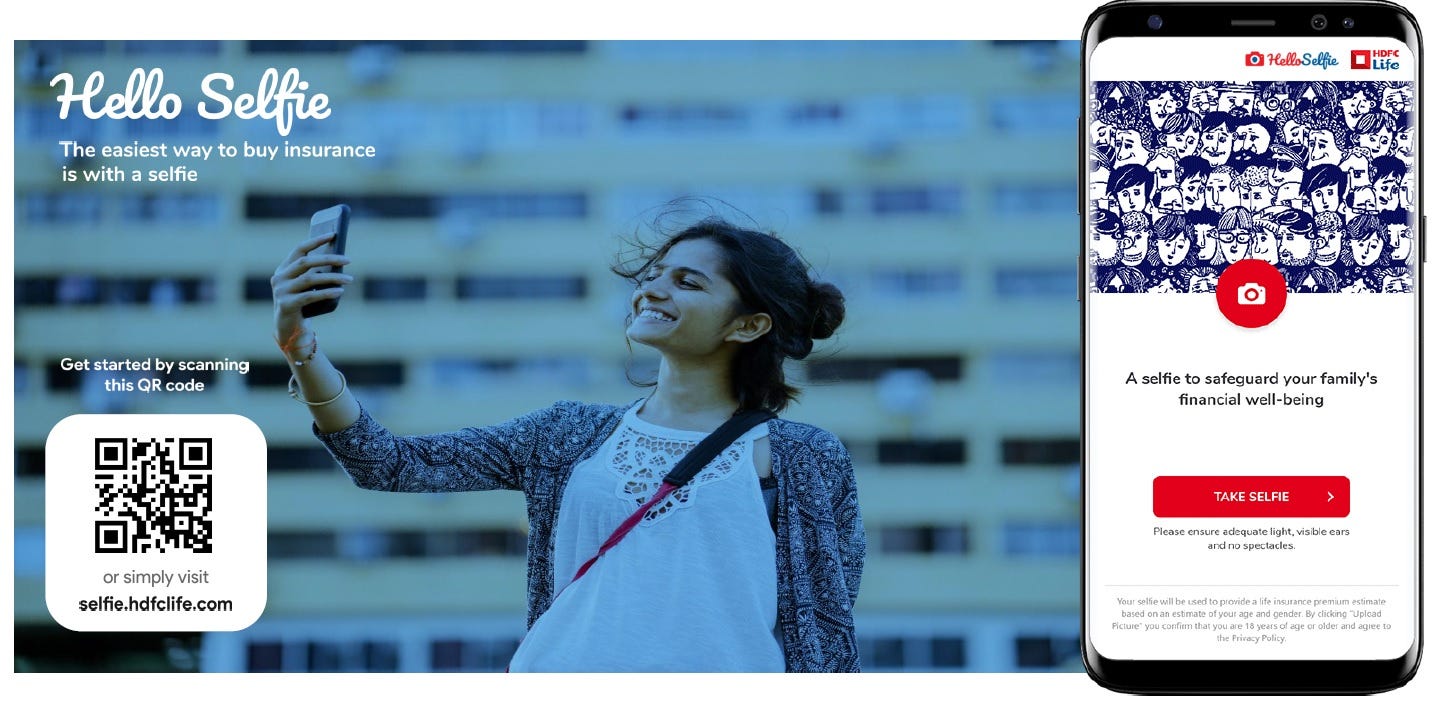

Buy Insurance with a Selfie

Covid-adapted Digital Journeys

VVISE – Video & Voice Interfacing Sales Enabler (an Industry-first)

b) Partner Integration: HDFC Bank, Paytm, Airtel and Partner Portal Life Next

c) Service Simplification:

24 x 7 Digital Services: Whatsapp Bot (Etty), Chat Bot (Ella), Alexa Bot (Elsa), E-Mail Bot (Spok)

Frictionless Digital Apps: Customer App, Life Easy, Life Certificate, Quick Register

Modified Branch Experience: InstaServ, Cloud Telephony, Video-Service, RPA

d) Data Labs: AI Capabilities to solve gaps at Scale

e) Platforms and Ecosystems: Life99 for Retired and Pension Segments

Impact: Improvement in All Lead Metrics

In Conclusion

Digital Enablers and Tools have accelerated the pace of development of Consumer Technologies, which have lead to customer expecting a superb ‘omnichannel/digital-driven’ experience even in traditional interactions with businesses like Insurance. Digital-first Insurance-focused Organizations are already meeting these expectations of Next-generation Customers and are competing with traditional players for a customer’s business. HDFC Life has shown the way with a proactive and determined pursuit of Digitally Transforming their business with a refreshed model that blends the best of physical and digital worlds. And, they are just beginning yet, if we are to go by their quote at one of the Events I had attended (and become an inspiration source for this post):

While we have invested significant management bandwidth and resources so far, we are acutely aware of the need to continue investing and treading this path of constant evolution, with technology as a key differentiator. And our future plans aim to do just that – from launch of products and solutions to further simplify and enhance customer experience, to bringing in more transparency to the life insurance sector by de-jargonizing complex products, we have a range of new initiatives in the pipeline.

I would be keenly watching them…

References and Sources

1) HDFC Life Tech Edge - Reimagining Insurance Dec 2019

2) HDFC Life - Default to Digital_Morgan Stanley Summit June 2020

3) HDFC Life - CLSA Conference Aug 2020