The 7-Eleven Retail Primer – Part 2

Last week we got a decent glimpse about what makes 7-Eleven click and how there are elements across their value chain which makes them thrive. Here is the post, in case you had missed it:

This week, Outside In covers more details of this super-efficient organization, with the hope that we will rediscover some of their best practices all over again – with a fresh perspective – and find some handy takeaways in our respective spheres of work

Since its establishment, 7-Eleven has always closely tracked changes in society and consumer lifestyles and has taken steps to enhance its own operations to meet emerging trends. It continues to implement reforms to support continued progress. This post covers the best practices of 7-Eleven Business Model

Corporate Philosophy

Modernization and Revitalization of Existing Small and Medium-Sized Stores

Co-existence and Co-prosperity

7-Eleven System that supports a Mutual Trust Relationship

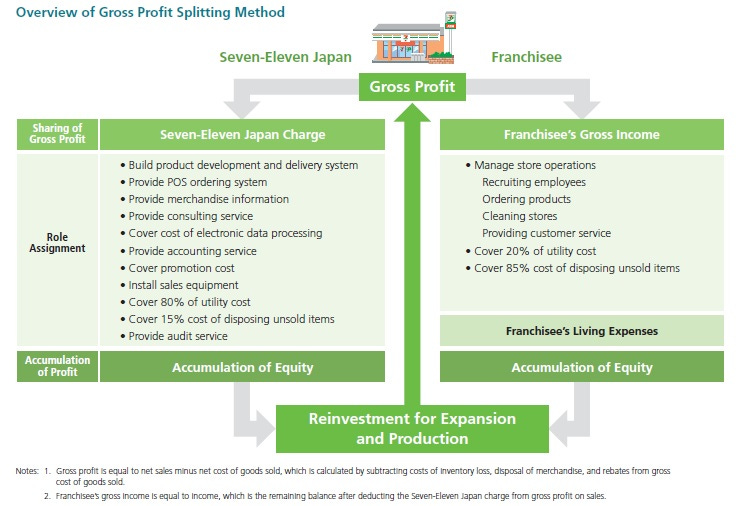

Gross Profit Splitting Method: A system in which gross profit of a store is split between the franchisee and HQ according to a pre-defined percentage

Open Account System: A settlement and financing system designed to enable franchisees to start their business even with a small amount of funds and to operate stably

Guaranteed Minimum Gross Income System: A system to guarantee franchisees a certain amount of franchisee’s gross income

Best Practice 1: ‘Profit-focused’ Original Franchise System –

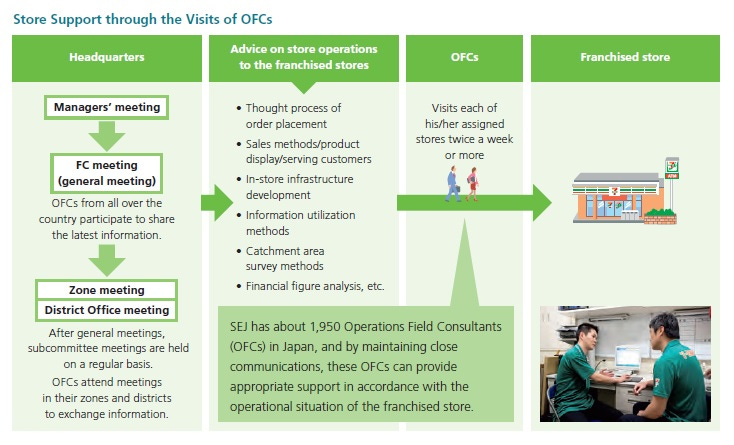

Under the franchise system, business operations are divided between the HQ and franchised stores. This system promotes coexistence and co-prosperity between 7-Eleven and franchisees. Aiming to “modernize and revitalize small and medium-sized retail stores,” they have implemented an original franchise system where both are on an equal footing, and there is a clear division of roles. The gross profit splitting method is used for the division of profit. As a result, the focus is not on increasing sales but rather on increasing gross profit, fostering co-existence and co-prosperity among all parties

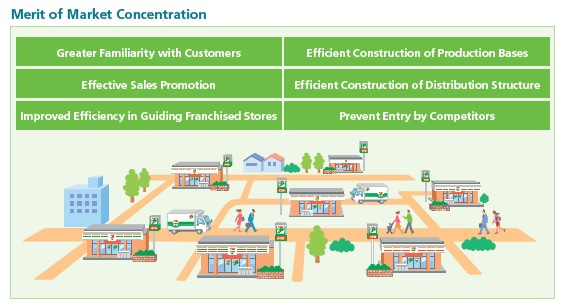

Best Practice 2: Concentrated Store Network –

High-density, concentrated store openings are the foundation of high-value-added products and services. Through the use of the market concentration strategy, 7-Eleven has been able to establish a distribution system and implement product strategies that leverage the distinctive features of high store densities. Moving forward, they will continue working to open stores with a focus on quality and enhancing profitability on a store-by-store basis

Best Practice 3: ‘Tanpin Kanri’ – Item-by-Item Management –

Tanpin Kanri means ‘management by stock-keeping unit’. It is a retail management practice focused on satisfying customer demand through a store-by-store approach to shelf management – that employs store-level human knowledge and information sharing about products – for the purpose of better understanding how certain conditions affect demand on a product-by-product basis, and then pursuing a cycle of product procurement, production, development and delivery that suits the demand

In contrast to SCM approach, where the normative merchandising practice that often feeds point-of-sale (POS) into an automatic replenishment system to reorder items that have been sold, the ‘demand-chain management’ system of Tanpin Kanri requires that store-based employees use POS data to identify which items are selling and which items are shelf-warmers (Shelf Warmers = Dead Inventory = Class of unmarketable goods which retailers could not sell at any price)

Then, by incorporating factors likely to influence demand, employees form hypotheses about which items are likely to sell

These store-level employees then place orders for those items that they believe will sell well in the future, in the amounts that believe will sell, rather than ordering items that have sold well in the past – as in the supply-chain management practice of replenishment

Under this system, slow-moving merchandise is quickly phased out, and fast-moving merchandise volume is increased to levels supported by the employees’ hypotheses about their local markets. New merchandise is brought into the cycle to replace the items lost, and total SKU count is maintained at roughly 2800 units

This system calls on 7-11 employees to personally observe customer activities within and beyond the store, hypothesize the psychology or pattern driving the activity, then customize the store layout, merchandising, and merchandise accordingly

There are at least 4 ways store employees can convey helpful information about products, to encourage purchase: Using attributes of the products themselves, Constructing helpful product mixes/assortments, Recommending and demonstrating products and Displaying inventively

Tanpin Kanri management practice encourages the employees to master not only the aspects of customer psychology and patterns of behavior that influence in-store purchase decisions, but also 3 classes of greater factors that influence demand: Time, Retail Context and Weather

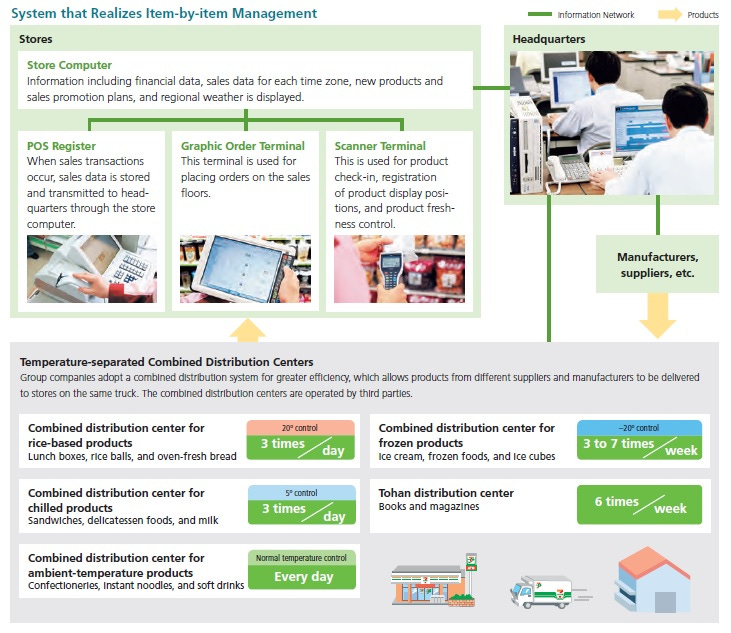

To implement item-by-item management, 7-Eleven has built original information systems and distribution networks and is working to maximize the efficiency of store operations as well as profits. It has built one of the world’s largest information networks, which links stores, HQ, combined distribution centers and suppliers. In addition, it has established a combined distribution system that is managed by 3rd parties. This is a practical system that offers logistics advantages for customers, franchised stores, and suppliers

Advantages of Temperature-separated Combined Distribution System: Under 7-Eleven’s combined distribution system, products from different suppliers and manufacturers are loaded onto the same truck and delivered to stores. With temperature-separated combined distribution, products are maintained at the appropriate temperature from supplier and manufacturer to store, facilitating the efficient delivery of fresh products to stores

Best Practice 4: Cultivate Original Products –

7-Eleven’s ability to differentiate its operations from those of competitors is the result of a lineup of more than 1,000 original daily food products. This lineup, which is its greatest strength, is the key factor behind strong store loyalty. It places a high priority on ensuring that the production facilities and distribution centers for its original daily food products are used only by 7-Eleven. This enables it to differentiate itself in the areas of product development, food safety management, and quality control

Best Practice 5: Services Development –

7-Eleven aims to meet customer needs with an expanded range of services and to increasingly offer “a close-by convenience store.” To make its stores a part of daily lifestyle infrastructure, it has expanded its range of services that are useful in daily life. A diverse range of services contributes to growth in the number of customer store visits. These services include ATM services, the acceptance of bill payments, meal delivery services, and ticket services provided with the use of multi-function copiers

In Conclusion

Contributing to local communities through the franchise business is the starting point of 7-Eleven business, and they believe that increasing the satisfaction of franchisees – their most important stakeholders – will drive 7-Eleven’s further growth in the years ahead. Moving forward, they plan to work together with franchise owners to realize “close by convenient” stores and to further enhance the 7-Eleven chain’s presence

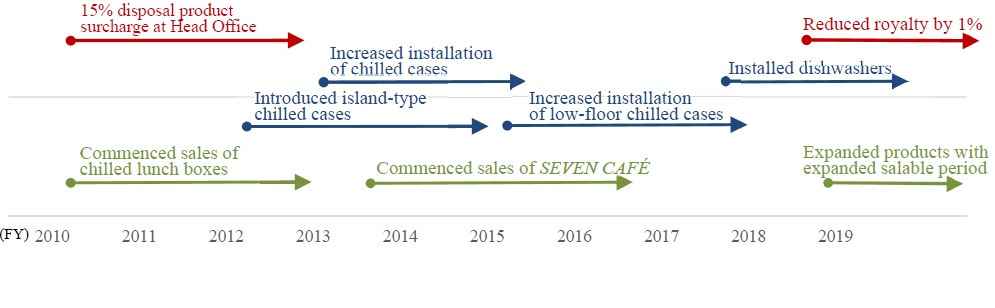

Check out these efforts to continuously support improvements in Profits at Franchised Stores in various ways below:

The 7-Eleven intent and action sound so authentic and believable, isn’t it? You bet…

References and Sources:

7-Eleven India Launch Update: https://www.cnbctv18.com/photos/retail/indias-first-7-eleven-store-opens-in-mumbai-11064562.htm

Porter Prize: https://www.porterprize.org/english/pastwinner/2003/12/03145411.html

Indian School of Business – My Own Case Study Notes on 7-Eleven

Inventory Turnover: https://jindal.utdallas.edu/~metin/Or6366/Folios/IntroStrategy/scseveneleven.pdf

7-Eleven Annual Reports