Zero CACs – The Zerodha Way

The explosion of Apps gave rise to the digital economy in the last 7-10 years and established them as, possibly, a primary consumer channel for engagement, transaction & retention. The rise of the Apps’ economy brought a persistent focus on a KPI called Customer Acquisition Cost (CAC) – what is the price businesses are paying to acquire a customer – make them download, transact and engage – to the App. As organizations spent large amounts of money to drive consumers to their App, CAC became a metric to gauge the direction of an organization’s chance of success – Too high and the business model was considered as unwieldy; Too low and doubts emerged if business was under-invested…

The discussions continue till date and I caught one recently on CNBC-TV18 YouTube channel covering India’s Digital Bazaar: What is the cost of the Unicorn Crown – which really triggered this post – here at:

In this conversation, there was a point made on how Zerodha – India’s Largest Stock Broker, which is hugely profitable unlike most (Indian) Start-ups – has a CAC of 0 (Zero). Yes, you read that right. Zerodha speaks about having a CAC of Zero – in this day and age, where some Apps have often spend 3X for revenue of X. That observation intrigued me enough to deep-dive into Zerodha’s customer acquisition practices, which could serve as best practices for most organizations with digital aspirations today. Here’s looking Outside In…

Business Summary

Zerodha operates as a “discount brokerage”, a stockbroker that takes very low commissions from trades it executes. The advent of technology has resulted in algorithms doing trading, advice and stock picking, which consequently has hammered broker fees. Commission rates have dropped from 1.2% in the 80s to nearly 0.1% today. This has resulted in the success of discount brokerages, like Zerodha. Bringing the advantage of technology to trading, and the internet to acquire customers, Zerodha has set out to build an Internet-first Trading Platform

Zero – A Business Model Structure

With no requirement to have a live broker, to execute trades or give advice, the company has literally no cost to execute a trade. This allows lowering the price per trade and, importantly, make pure margin per trade. Taking cue from the e-commerce industry’s ‘deep discounting’ approach, Zerodha lowered their fees to a flat Rs. 20 per trade, instead of commission percentages – which incentivized higher volumes through Zerodha

Zero – A Philosophical Decision

Nikhil Kamath: CAC at 0 is a philosophical decision. Philosophical because we aren't in a hurry to grow or get to X valuation. We believe that if you can build products with the customers' best interests at heart and enjoy the journey as a team, we'll continue to do okay. The rest is anyways not in our control.

We run a referral & partner program, but we don't pay any upfront charges but share a fixed % of revenue generated. The issue with having an upfront CAC is that you can be forced to think about how to recover it. That might mean doing something that's not right for customers.

This is also why we don't have any revenue & sales targets. In the business of money, it's very easy to push customers into bad products. The issue with not doing what is right for customers is that organic growth stops & then you have to continue to spend on CAC forever.

The challenge for Indian B2C businesses is that while millions of users can be acquired by spending, the audience that can generate revenue to cover the CAC is small.

Use of FOSS (Free and Open Source Software)

Right from support tickets to sales CRM (customer relationship management) to HRMS (HR management systems) and even the e-mail utility everything is built on the FOSS platform. It saves them tens of millions of dollars. The tech architecture is not only good in terms of performance given the number of users it can handle, but also by the number of people engaged in building it – they have built the entire business internally with a tech team of just 30 people.

They have been able to onboard millions of users without having to double tech expenses. They have been able to go from 2 million to 10 million customers without increasing their team size, because it has used tech to optimize and improve every single process

Focus on the Right Consumer Segment for Product-Market Fit

There are essentially 3 groups of traders in India:

Group 1 is the “Equity investors” who buy and hold stocks for a long time. This accounts for ~1% of the total trade volume in the market

Group 2 are the Intraday traders constituting 9% of the total trade volume

Group 3 are the Future and Options (F/O) traders. They account for 90% of the trade volume

70% of Upstox’s users are first-time investors from Tier 2–3 cities that they acquired due to Covid's impact. Also, they focus on the millennial segment which has a lower purchasing power than other age segments. Millennials are also busy in their professional sphere as these are early parts of their career and aren’t regular traders. So, Upstox is basically spending Crores to get people in that Group A which only makes 1% of the transactions with low frequency

Meanwhile, Zerodha has built a platform for serious F/O traders i.e. Group 3. This strategic move to focus on Group C users helped Zerodha multiply its profits year over year. Also, Zerodha’s focus was to get the usability right and not to worry too much about UI/UX or user engagement

Zero Spends – Early Marketing Strategy – Word-of-Mouth

Nithin Kamath was very clear on one thing — people don't really get interested in trading or start investing by coming across ads about investing. Most likely, investors get interested in trading after having a conversation with a friend or a reliable/respected acquaintance or mentor. So, all marketing would've to be through Word-of-Mouth. It mainly had 2 ways of marketing their startup: Community Outreach and Offline Telemarketing

Community Outreach

During his trading days, Nithin was part of quite a few trading communities. These are your simple groups on platforms like Reddit, Yahoo! Messenger, etc. In fact, he himself was running a few of the large communities. So, basically, he was quite well-known. He used this to his advantage by distributing the early version of Zerodha on these Communities

Offline Telemarketing

Nithin Kamath himself was going door to door dressed as "Sachin the salesman guy". He was working on getting prospective users & referrals signed up on the platform. With community outreach and offline door-to-door marketing, Zerodha gained its first 1000 customers

‘Low’ Cost – Referral Program, Business Affiliates and Digital Marketing

The strongest pillars of Zerodha marketing now are the referral and affiliate programs. Rather than investing in Ads, they came up with the idea of giving commission to their referrals. Many bloggers and YouTubers promote the services through affiliate programs on their platform, and in return, they earn commission on every purchase. The referral program has helped Zerodha to discover thousands of leads that without zero upfront cost

With digital marketing, they have kept their users engaged on the platform by offering to educate with blogs and much more. They offer content that educates users, and it brings a chunk load of traffic. It provides a subscriber base and improves their authority of the domain on Google

Zero CAC – Actual Mechanics

According to a note by ajuniorvc.com in 2018, Zerodha spent INR 260 Crores on Marketing – adding 400K customers in the process (from 100K to 500K). Thereby, the CAC was INR 260 Crores/400K = ~INR 6500/-. For a customer that did 4 Trades/Day i.e. INR 80/Day, it would take around 80 Days (6500/80) for Zerodha to be profitable on its customer. Zerodha had a customer acquisition cost payback of around 3 months only!

In FY 21, Zerodha had revenues of INR 2729 Crores with a profit of INR 1122 Crores. Its overall user base stood at 90 lakh and an active user (one who trades at least once a year) size of nearly 62 lakh. That gave Zerodha a profit of over INR 2100 per User

Sign-Up Fees

According to Nithin, a sign-up fee of ₹200 that it charges per customer while on-boarding partly contributes to its overall revenue. “We make money on Customer Acquisition unlike competition which is losing money. So, it’s almost like a negative customer acquisition cost (CAC).”

Comparison with Upstox

Upstox spends a chunk of its money on acquiring users and has a very high CAC. ~65% of Upstox’s users join through referrals. Upstox pays INR 1200 per referrer

Even if 50% referrer payments are to be made, it means nearly 25 lakh users that Upstox needs to pay. This leads to INR 300 Crore cash burn on their balance sheet, which is nearly 66% of their overall costs

So, while Zerodha spends 36% of revenue on its operational costs (lowest in the industry), Upstox spends 66% of its capital simply acquiring referrals only

Zerodha – A ‘Zero-focused’ Ecosystem

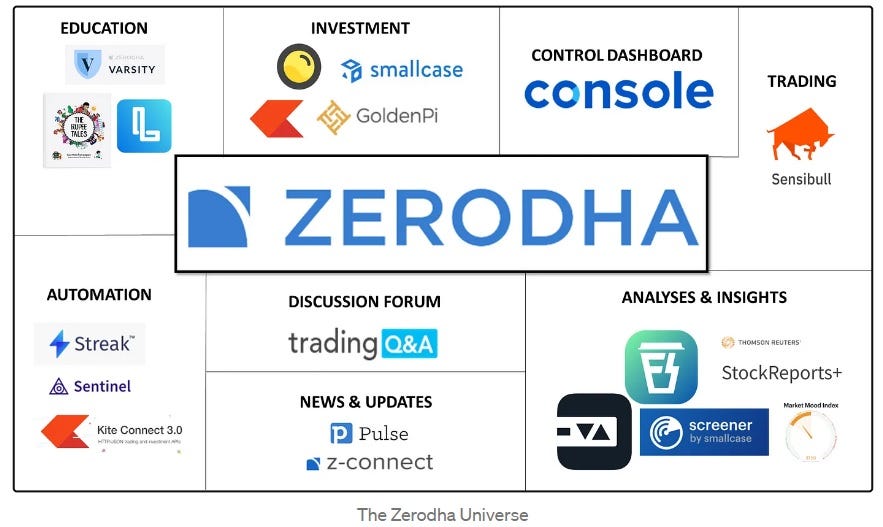

Today, the ‘Zerodha Ecosystem’ can be mapped across most of the needs of a “Personal” Finance Management lifecycle today. Most important of all, almost all of them are either free or very affordable. Interestingly enough, they don’t advertise. It is word of mouth (and published word) that enabled them to grow to what they are today

Read more at: https://imnishantg.medium.com/the-zerodha-universe-2020-6e90e0141bd8

In Conclusion

The real magic of Zerodha’s success is “Customer Stickiness”. Trading is a trust business and once traders trust them, they rarely leave. While Zerodha may actually have a high CAC, it earns a phenomenal Customer Lifetime Value (CLV) – which is pure profit beyond the first 3-months. In effect, the business has been raising new capital from its existing customers – through profits. And these older customers are really funding the acquisition of its newer customers. This flywheel is really Zerodha’s Zero CAC…

References and Sources

1) Nithin Kamath post on Philosophical Decision: https://www.linkedin.com/posts/nithin-kamath-81136242_we-get-asked-often-how-is-zerodha-profitable-activity-6911966768177573888-G7_7/

2) Zerodha – A Money-making Machine: https://ajuniorvc.com/zerodha-fintech-money-machine/

3) Fortune Magazine Story: https://www.fortuneindia.com/long-reads/how-zerodha-went-from-zero-tohero/111627

4) Upstox Comparison: https://medium.com/@Sahil_Sapru/demystifying-startups-1-tale-of-two-startups-who-plan-to-democratize-personal-investment-7a00a1f91394

5) Early Marketing Strategy: https://buildd.co/marketing/zerodha-marketing-strategy

6) Referrals & Business Affiliates: https://startuptalky.com/zerodha-marketing-strategy/

7) Zerodha Ecosystem: https://imnishantg.medium.com/the-zerodha-universe-2020-6e90e0141bd8